Inheriting property can be a significant life event, often accompanied by a mix of emotions. Whether you’ve inherited a family home, an investment property, or a piece of land, knowing what to do next is crucial for a smooth transition and wise decision-making. In this article, we’ll provide you with a comprehensive guide on what to do if you inherit property.

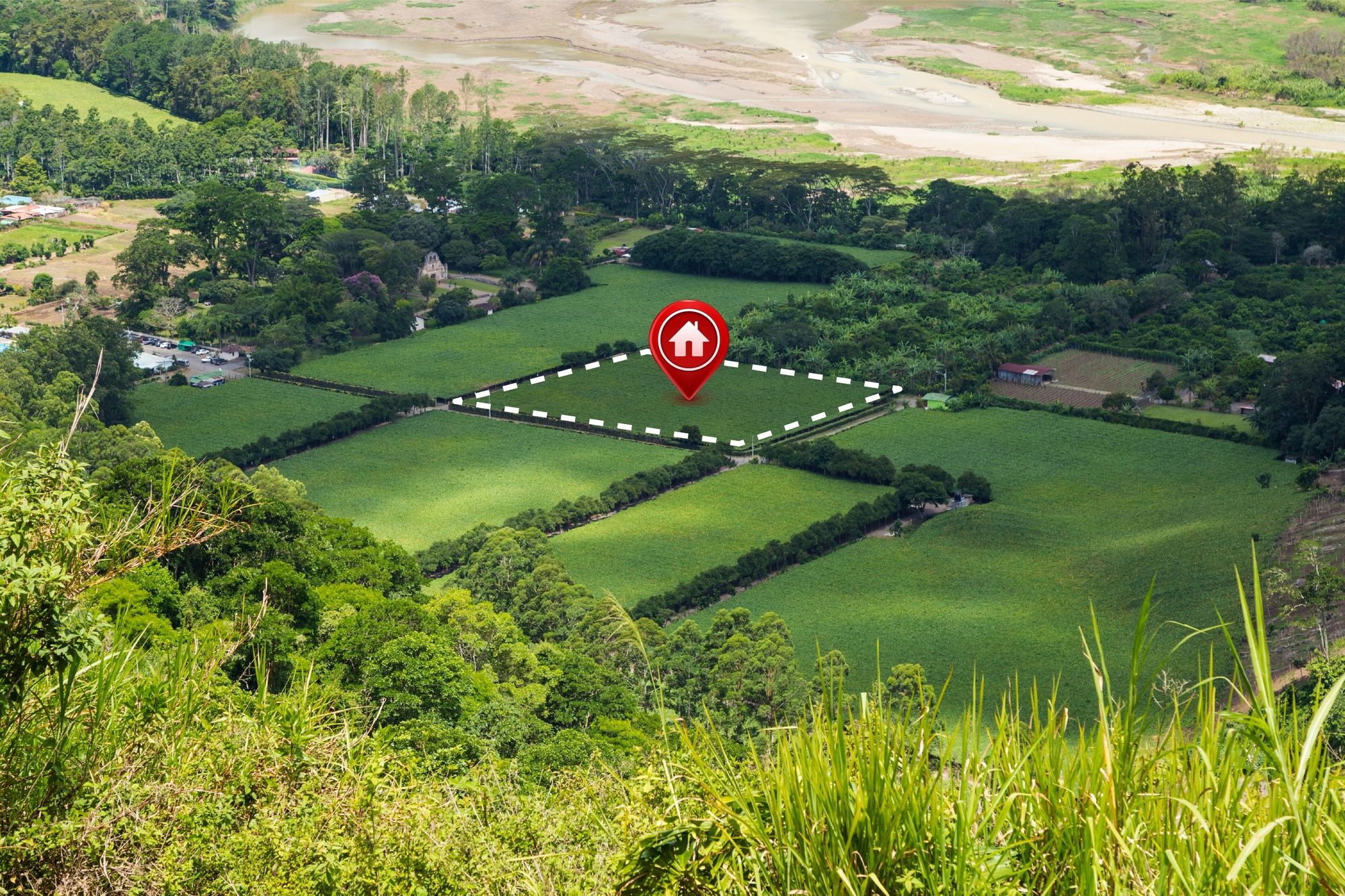

Before taking any steps, it’s essential to understand the type of property you’ve inherited. Is it residential or commercial real estate, undeveloped land, or a vacation home? Knowing the nature of the property will influence your decisions regarding its management or sale.

Review the deceased’s will and any legal documents related to the inheritance. These documents will outline the deceased’s wishes regarding the property’s distribution and any specific instructions you need to follow.

Visit the inherited property and assess its condition. Identify any immediate maintenance or repair needs. Taking care of issues promptly can help maintain the property’s value.

Consider the financial responsibilities associated with the property. This includes property taxes, insurance, and ongoing maintenance costs. Ensure that you have a plan in place to cover these expenses.

You have several options when you inherit property:

Consult with a tax advisor to understand any tax implications of the inheritance, including property taxes and capital gains taxes upon sale.

Consider consulting with an attorney who specializes in real estate and estate planning. They can provide valuable guidance on the legal aspects of property inheritance.

Inform relevant parties about the inheritance, including insurance companies, local authorities, and utility providers. Ensure that the property’s utilities and insurance coverage are updated as needed.

Maintain open communication with family members or other beneficiaries involved in the inheritance. Collaboration and transparency can help avoid conflicts and make informed decisions.

Consider the long-term implications of the inherited property on your financial goals and estate planning. It may be necessary to update your own estate plan accordingly.

Inheriting property can be both a blessing and a responsibility. Taking the time to understand your options, consult with experts, and make informed decisions will ensure that you handle your inheritance wisely and in a way that aligns with your financial and personal goals.